arizona solar tax credit 2019

Arizona Department of Revenue E-Services applications AZFSET Portal and 1099-G will be unavailable due to scheduled. The RCP rate allows customers to receive a credit for excess energy sent to the grid.

Are Solar Panels Worth It In Arizona Yes Ae Llc

Arizona for example provides a sales tax.

. The co-op has 35 members currently signed up. 2021 Claim for QEZE. We contracted w TFS at the end of 2019.

2019 Solar Power Myths Debunked. Local and Utility Incentives. Getting a Refund From the Arizona Solar Tax Credit.

April 11 2019. Arizona Open Meeting Law ARS 33-1804Condo ARS 33-1248. 2017 Tax Credit.

42-5014 and 42-1129. TFS was willing to put the. 2021 Claim for EZ Capital Tax Credit.

Any bill credit in excess of the customers otherwise applicable monthly bill will be credited on the next monthly bill or subsequent bills if necessary. Year E-File and E-Pay Threshold. To schedule an appointment please contact us at email protected.

Sales tax incentives typically provide an exemption from the state sales tax or sales and use tax for the purchase of a solar energy system. Then the pandemic hit and we werent sure what was going to happen to our business. Like the other credits in this article it will also rollover.

If you credit is greater than your tax liability it will not generate a tax refund. Every resident in Arizona who installs solar panels gets a State Tax Credit of 25 of the total system cost up to 1000 to be used toward State income taxes. 2021 Claim for EZ Investment Tax Credit and EZ Employment Incentive Tax Credit.

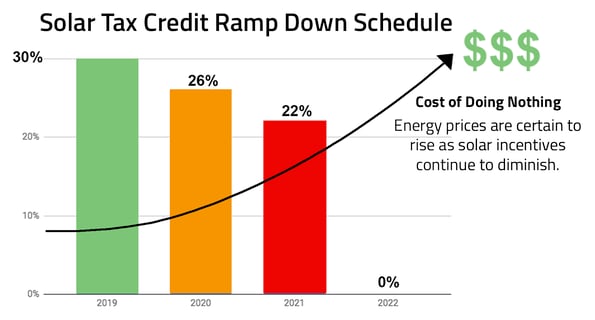

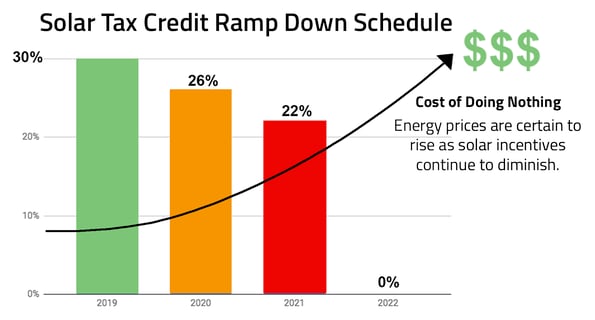

State to require solar panels on almost all new homes starting in 2020meaning TPO solar will soon become a lot more. What is the California solar tax credit for 2021. Currently the federal tax credit for solar installations and other renewable energy systems is at 26.

Photovoltaic cells convert light into an electric current using the photovoltaic effect. 2019 Tax Credit. 2019 Tax Credit.

With the Arizona solar tax credit the credit caps at 1000 or 25 percent of the value of the system whichever is lower. Military Reuse Zone Credit. Arizona has a program that is very similar to New Mexicos with some minor changes to the actual amounts.

Here are the ones most commonly used by homeowners to reduce their solar panel costs and shorten their solar payback period. That number is set to drop to 22 in 2023. How Do I Claim My Residential Solar Tax Credit for 2017.

All American households are eligible for the federal solar tax credit which is. If you or your client has an issue with an HOA discuss the problem with and ask questions of a real estate attorney familiar with HOA law in Arizona. September 26 2017.

April 18 2019 What is Net Metering. 500 annual transaction privilege tax and use tax liability Pursuant to ARS. 2019 Tax Credit.

It depends on the solar rate you choose - RCP or EPR-2. Solar power is the conversion of renewable energy from sunlight into electricity either directly using photovoltaics PV indirectly using concentrated solar power or a combination. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer.

2021 Claim for ZEA Wage Tax Credit. Beginning May 16 customers will be rerouted to the north entrance while building improvements are made. If your tax bill is 300 but your non-refundable tax credit is 1000 you will only use 300 of your credit and will have 700 unused.

Concentrated solar power systems use lenses or mirrors and solar tracking systems to focus a large area of. The federal solar tax credit also known as the solar investment tax credit or ITC offers new solar owners in the United States a tax credit equal to 26 of costs they paid for their solar installation. 2019 Tax Credit.

The solar tax credit is worth 26 of the value of the system installed and can be claimed on federal tax returns. Here is a quick overview of some of the laws pertaining to HOAs. Electric Vehicles Solar and Energy Storage.

This type of exemption helps to reduce the upfront costs of a solar installation. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Arizona solar tax credit.

Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. Fortunately the Geothermal Tax Credit allows homeowners to apply their tax credit over multiple years. This is not a complete list.

A few months later regulators would vote to make California the first US. Blue Raven Solar. Environmental Technology Facility Credit.

There are 25 states that offer sales tax exemptions for solar energy.

3 Solar Incentives To Take Advantage Of Before They Re Gone

Solar Tax Credit In 2021 Southface Solar Electric Az

Solar Tax Credit In 2021 Southface Solar Electric Az

Federal Solar Tax Credit For Homeowners Complete Guide Energysage

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

We Offer Fast Safe And Reliable Jump Start Service Https Www Losangeles Towingservice Com Jump Start Your Convenience Is A Start Jump Roadside Assistance

Nashville Man Brings Solar Energy To Minority Communities Npr

Yes Your Solar Panels Can Make You Money Cnet

Solar Vs Wind Energy Sunpower Solar Blog Lắp đặt điện Mặt Trời Hcm Khải Minh Tech Http Thesun Solar Most Efficient Solar Panels Renewable Energy Technology

College Going Check In Seniors At Our South Phoenix High School Campus Are Killin It Right Now At Least 97 Have Been School Campus College Bound High School

Solar Tax Credit Top Tips For Taking This Credit On Your Rv

Solar Tax Credit Details H R Block

How Does The Federal Solar Tax Credit Work Freedom Solar

How Much Of A Down Payment Do I Need To Buy A House Down Payment Home Buying Tips Payment

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Homer Software For Microgrid And Distributed Generation Power System Design And Optimization Generation Software Software Design

/cdn.vox-cdn.com/uploads/chorus_image/image/70594650/rsz_adobestock_166916488.0.jpg)

Federal Solar Tax Credit What Homeowners Need To Know This Old House